trust capital gains tax rate 2021

The following are some of the specific exclusions. There are seven federal income tax rates in 2023.

Capital Gains Tax Brackets For 2022 What They Are And Rates

Short-term capital gains from assets held 12.

. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. 2022 Long-Term Capital Gains Trust Tax Rates.

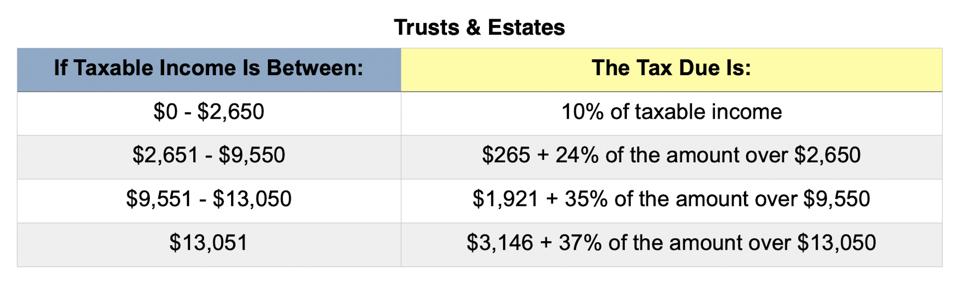

2021 Long-Term Capital Gains Trust Tax Rates. The following Capital Gains Tax rates apply. Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates.

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. Find out more about Capital Gains Tax and trusts. They would apply to the tax return.

In 2021 to 2022 the trust has gains of 7000 and no losses. Add this to your taxable. 2021 Trust Tax Rates and Exemptions - Yahoo.

It continues to be important to obtain date of. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing. Trusts and Capital Gains.

They are subject to ordinary income tax rates meaning theyre. Long-Term Capital Gains Taxes. Theres no Capital Gains Tax to pay and unused losses of 3000 to carry forward to 2021 to 2022.

Work out your tax - GOVUK 2 weeks ago Apr 05 2022 Theres no Capital Gains Tax to pay and unused losses of 3000 to carry forward to 2021 to 2022. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

An individual would have to make over 518500 in taxable income to be taxed at 37. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed. Events that trigger a disposal include a sale donation exchange loss death and emigration.

Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and. Short-term capital gains are gains apply to assets or property you held for one year or less. 2020 to 2021 2019 to 2020 2018 to 2019.

Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. Top federal marginal tax rate for ordinary income applicable for taxable income over 622050 joint and 518400 single in 2020 and 628300 joint and 523600. What is the 2021 capital gain rate.

However it was struck down in March 2022. Includes short and long-term Federal and State Capital. Irrevocable trusts are very different from revocable trusts in the way they are taxed.

Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021. Short-term capital gain tax rates. Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount.

Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000. 1 week ago Nov 17 2021 2021 Long-Term Capital Gains Trust Tax Rates. The tax-free allowance for.

First deduct the Capital Gains tax-free allowance from your taxable gain. 2021 Long-Term Capital Gains Trust Tax Rates 0. Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term capital gains rate with even modest profits.

In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

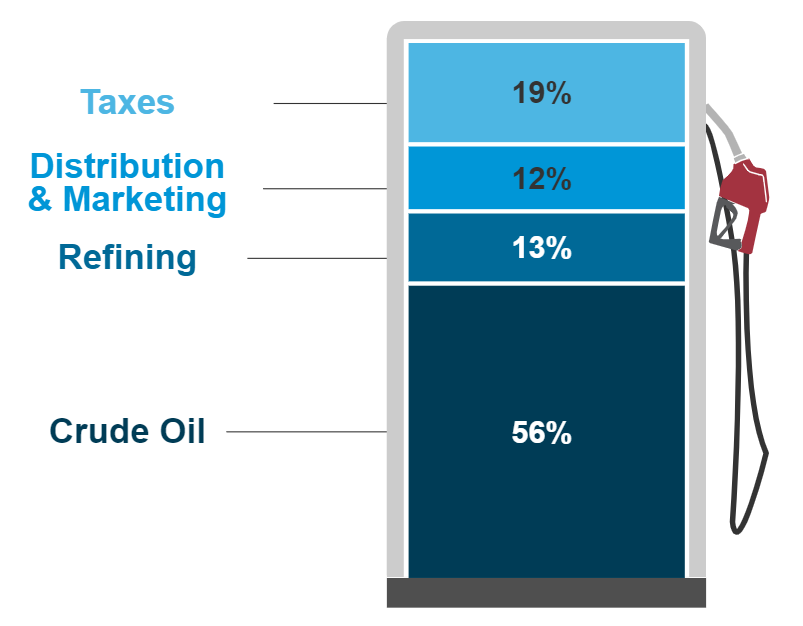

Motor Fuel Data Policy Federal Highway Administration

Dividend Tax Rate For 2022 Smartasset

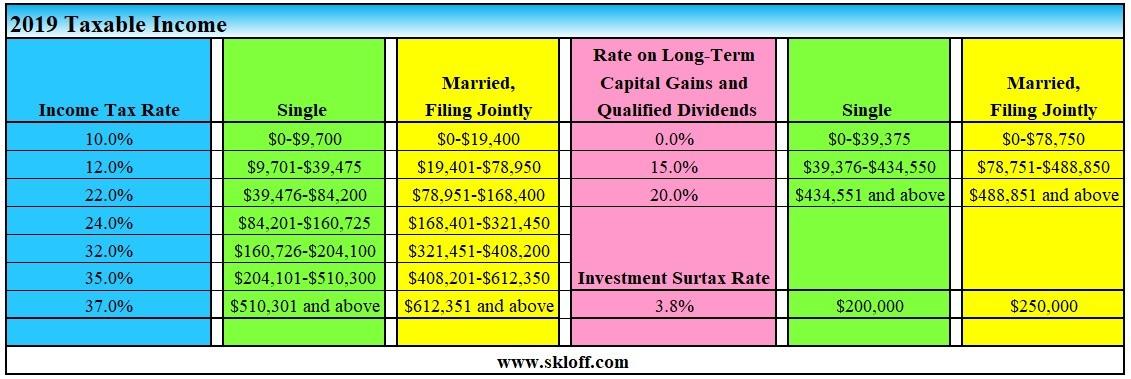

Income Tax And Capital Gains Rates 2019 03 01 19 Skloff Financial Group

Build Back Better Thin Margin In Congress Foreshadows Change Negotiation Advisor Magazine

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Income Tax Accounting For Trusts And Estates

Cryptocurrency Taxes A Guide To Tax Rules For Bitcoin Ethereum And More Bankrate

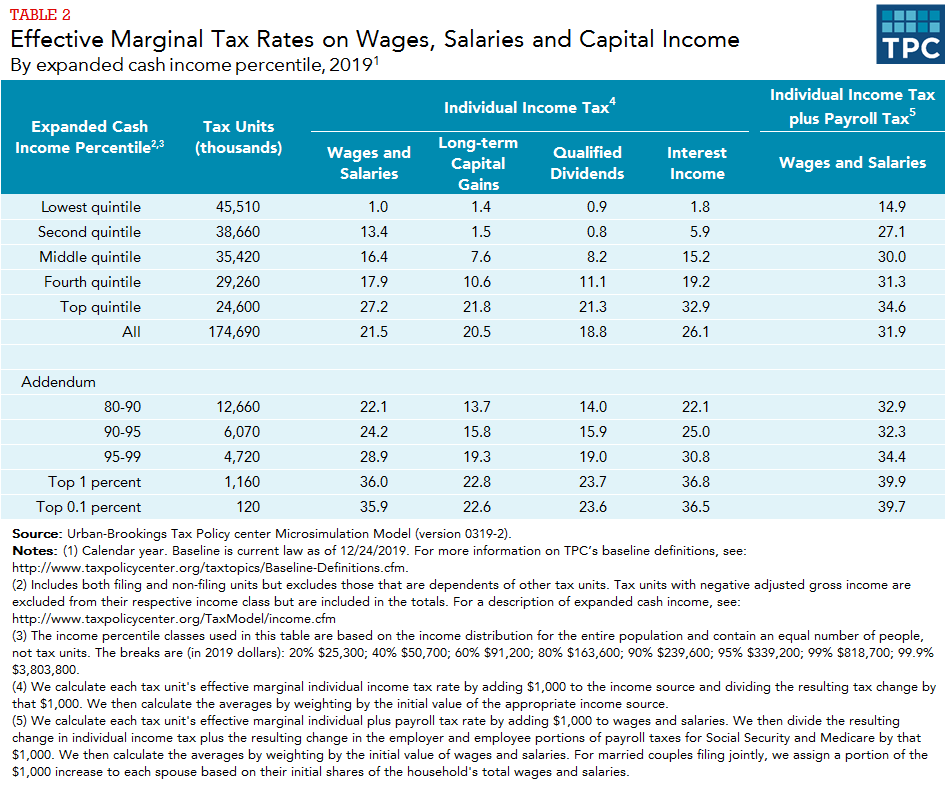

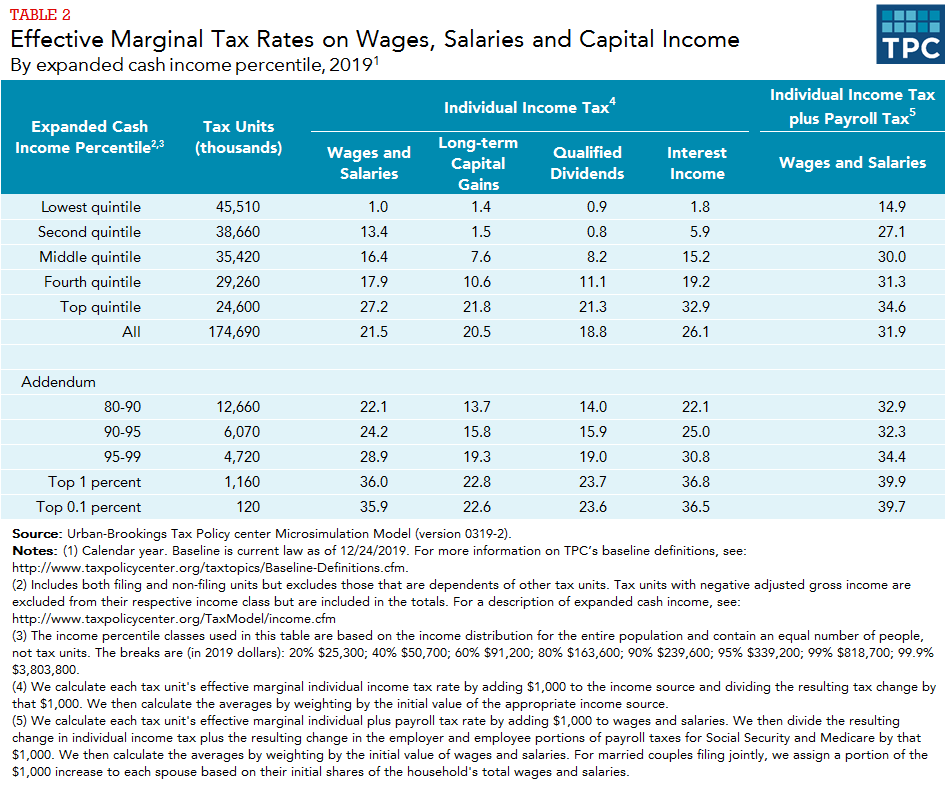

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center

Avoid Capital Gains Tax On Inherited Property Law Offices Of Daniel Hunt

Biden Capital Gains Tax Rate Would Be Highest In Oecd

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger

New Tax Initiatives Could Be Unveiled Commerce Trust Company

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More The Wealthadvisor

Tax Advantages For Donor Advised Funds Nptrust

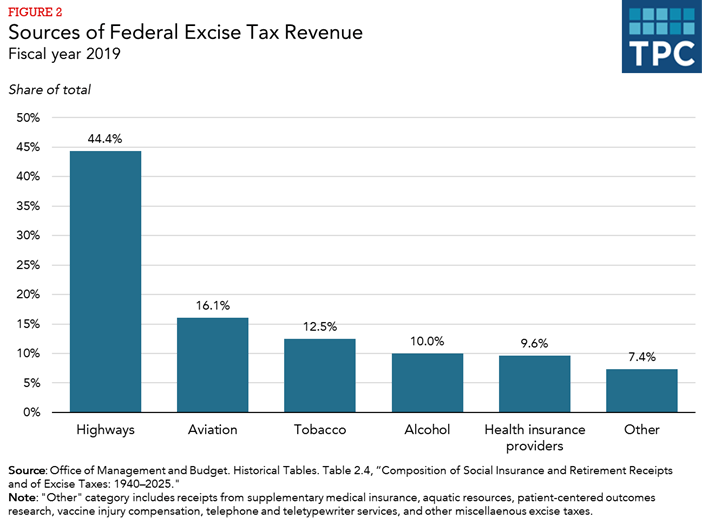

What Are The Major Federal Excise Taxes And How Much Money Do They Raise Tax Policy Center

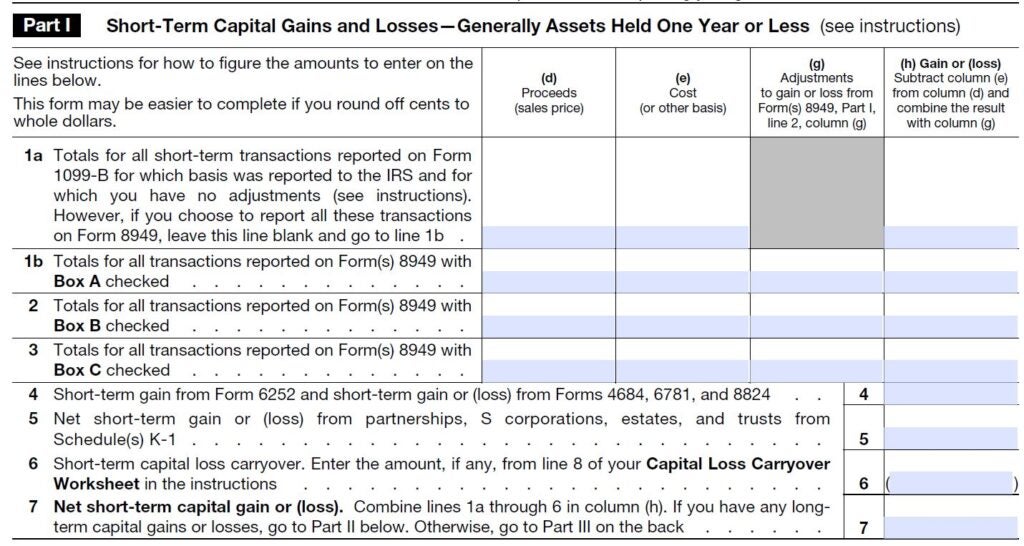

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

2022 Capital Gains Tax Rates Federal And State The Motley Fool

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

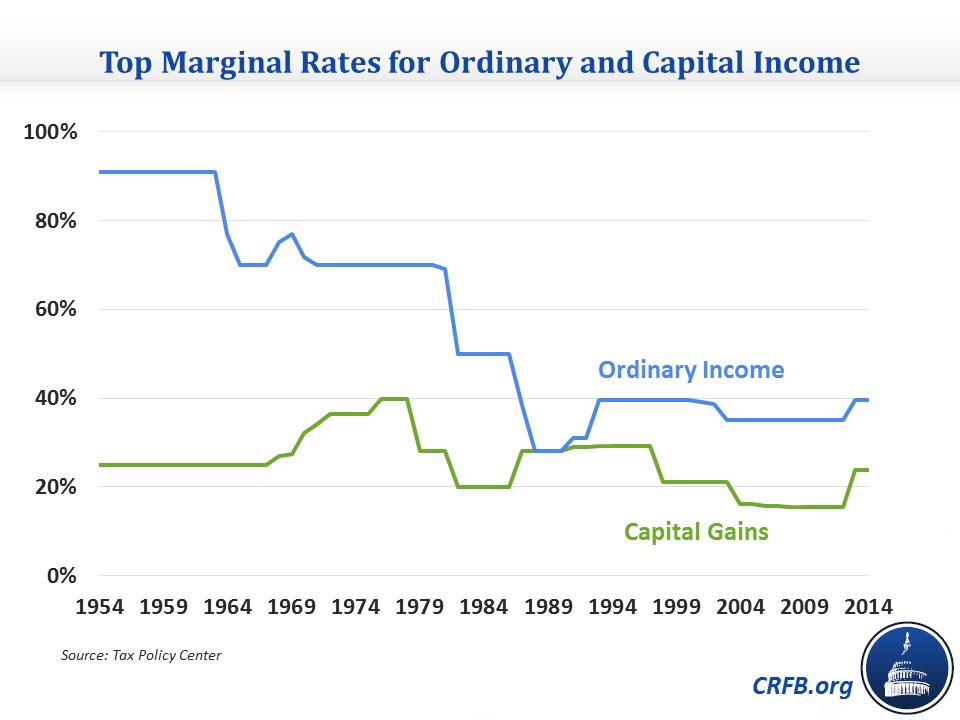

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget